Present value factor calculator

Use the PV of 1 Table to find the rounded present value factor at the intersection of n 10 and i 3. Whether Company Z should take Rs.

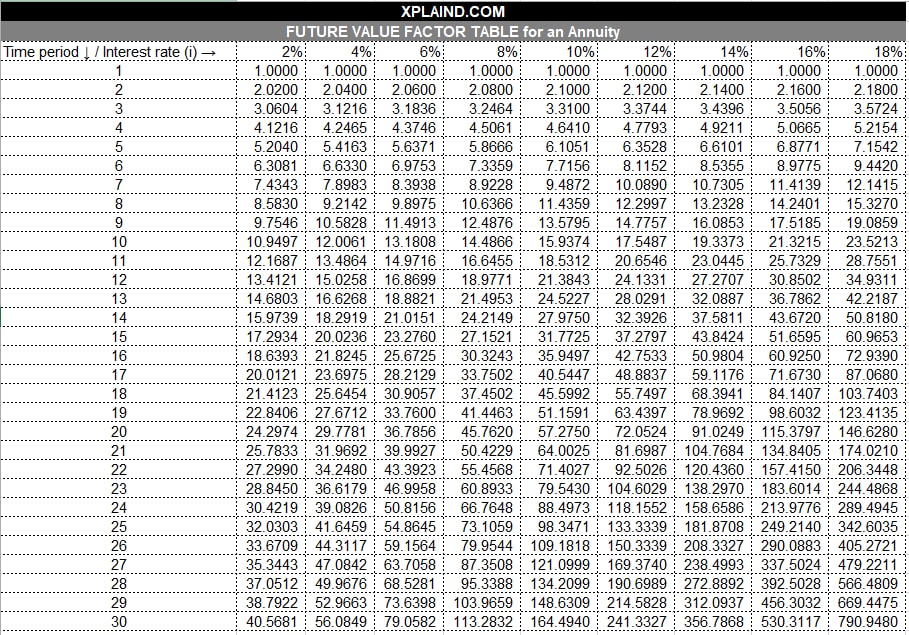

Future Value Annuity Due Tables Double Entry Bookkeeping Time Value Of Money Annuity Table Annuity

The net present value calculator exactly as you see it above is 100 free for you to use.

. Type the number into a text editor with no formatting and copy from there then you can paste the value into the calculator and the number will be autoformatted. It is a factor used to calculate an estimate of the present value of an amount to be received in a future period. 5000 if the present value of Rs.

Money out - negative values. If more integers were present the same process would be performed to find the GCF of the subsequent integer and the GCF of the previous two integers. Examples of Variance Analysis Formula.

You may also look at the following articles to learn more Guide to Present Value Factor Formula. The calculator only expects users to type numbers only and the calculator takes care of formatting the numbers with thousands separators. There is a workaround.

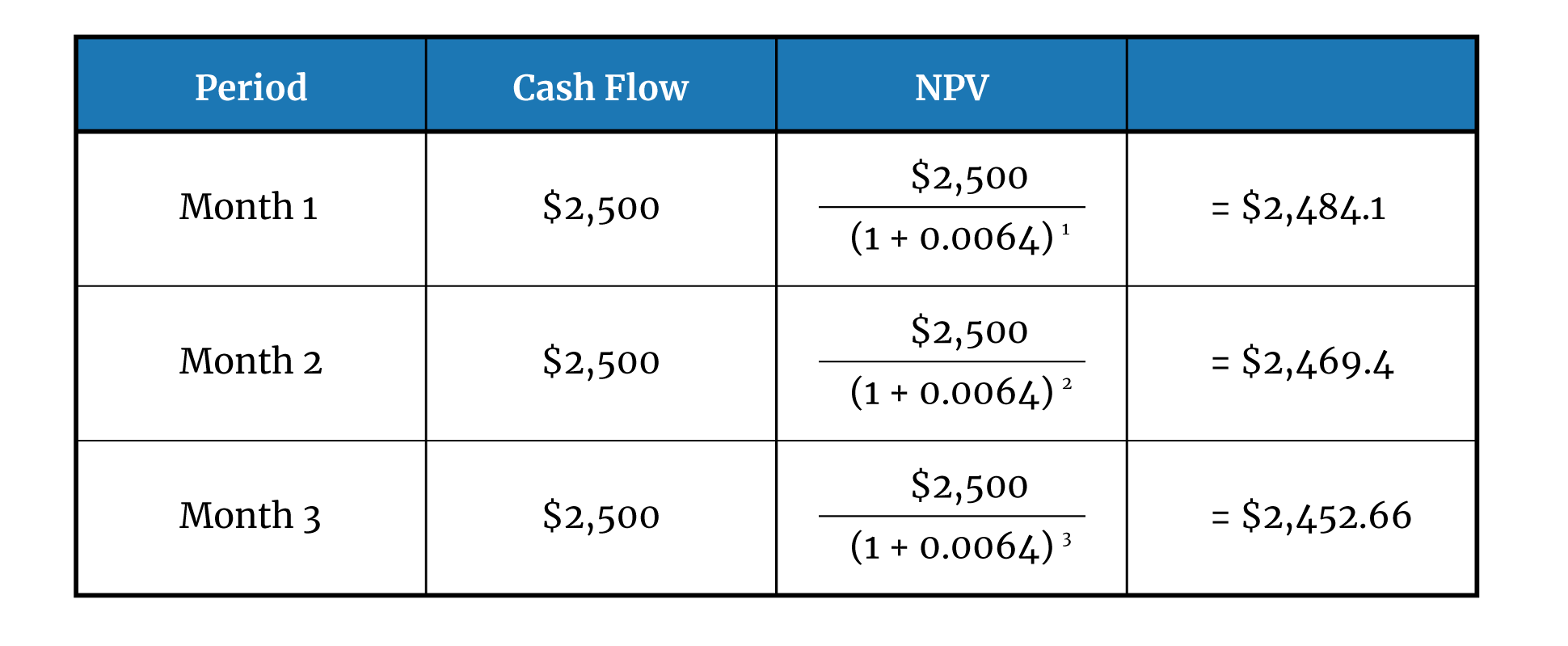

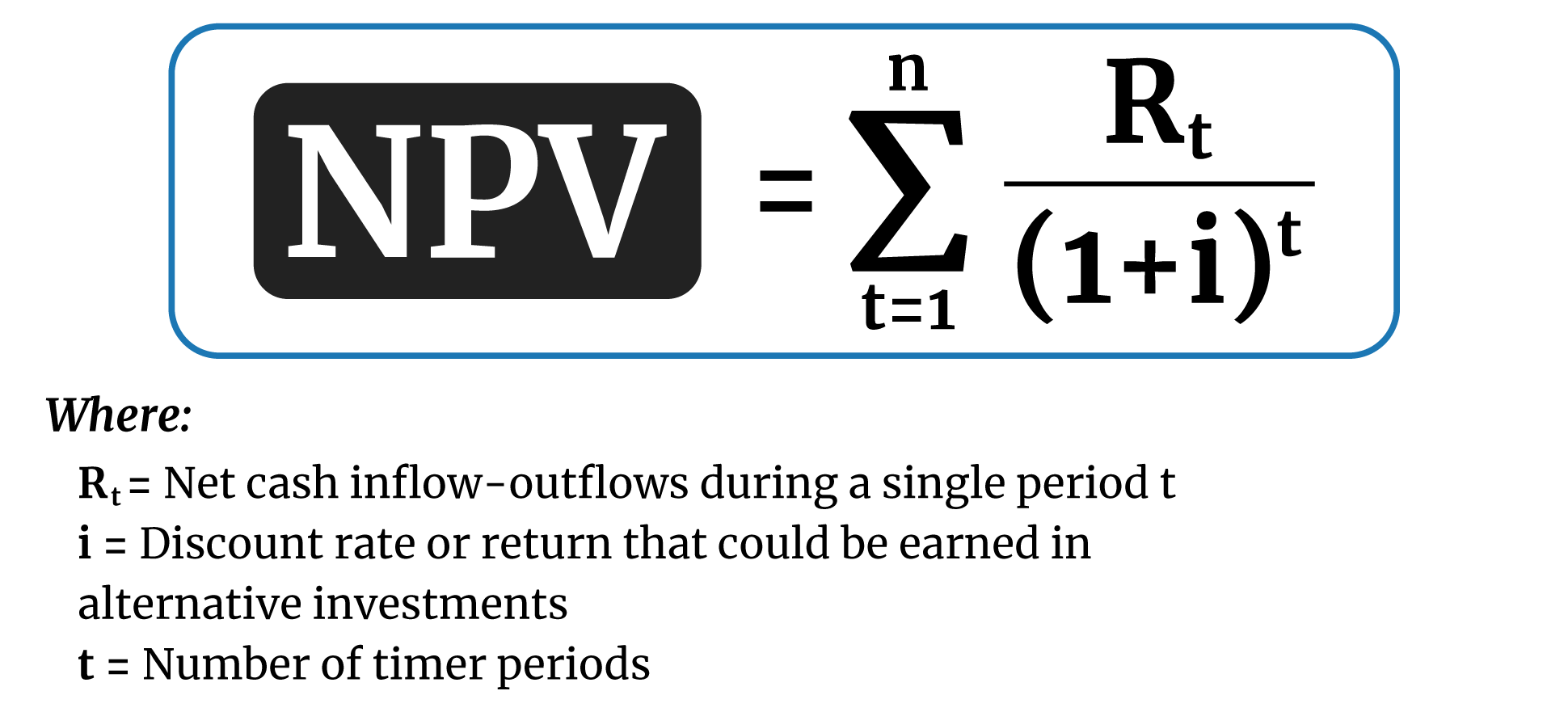

The present value is given in actuarial notation by. Now in order to understand which of either deal is better ie. The present value formula applies a discount to your future value amount deducting interest earned to find the present value in todays money.

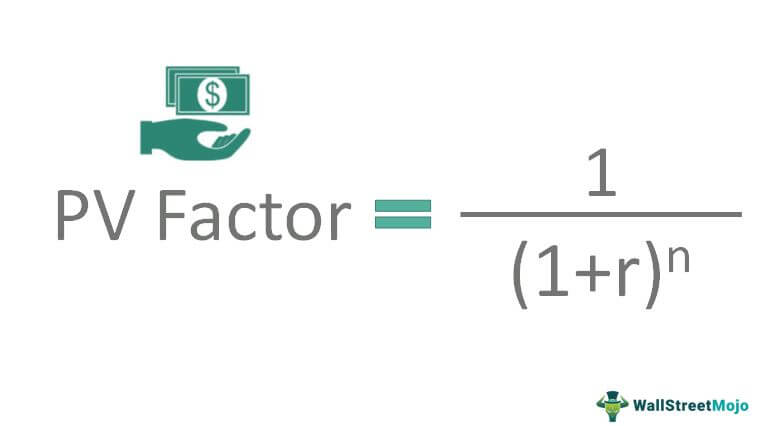

The present value factor is the factor that is used to indicate the present value of cash to be received in the future and is based on the time value of money. How to calculate discounted net present value in a typical renewable energy project. The present value of an annuity is the value of a stream of payments discounted by the interest rate to account for the fact that payments are being made at various moments in the future.

The future cash flows of. Future cash flows are discounted at the discount. Enter the earnings per share of the company.

The cash flow may be an investment payment or savings cash flow or it may be an income cash flow. Within this automatic NPV calculator you are able to enter up to 10 separate cash flows to factor in. The calculator first converts the number of years and.

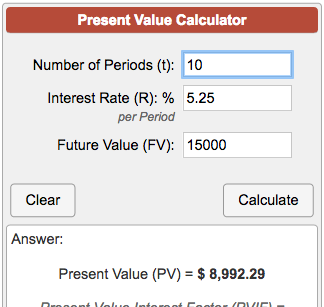

Present value PV is the current worth of a future sum of money or stream of cash flows given a specified rate of return. Not ideal but it does. Present Value Formula and Calculator The present value formula is PVFV1i n where you divide the future value FV by a factor of 1 i for each period between present and future dates.

Net Present Worth Calculator - Variable Cash Flow Stream. If youd like to know how to estimate compound interest see the article on. The calculator below can be used to estimate Net Present Wort - NPW - in an investment project with up to 20 periods and variable cash flows.

If you want to customize the colors size and more to better fit your site then pricing starts at just 2999. If you kept that same 1000 in your wallet earning no interest then the future value would decline at the rate of inflation making 1000 in the future worth less than 1000 today. Here we have discussed How to Calculate Present Value along with practical examples.

Input the expected annual growth rate of the company. 5000 today or Rs. You can apply this factor to other future value amounts to find the present value with the same length of investment interest and compounding rate.

5500 after two years we need to calculate a present value of Rs. The present value of receiving 10000 at the end of five years when the compounding is semiannual requires that n 10 5 years X 2 semiannual periods per year and that i 3 6 per year two semiannual periods in each year. 5500 on the current interest rate and then compare it with Rs.

Present Value Example Problem. The present value of annuity formula relies on the concept of time value of money in that one dollar present day is worth more than that same dollar at a future date. Present Value - PV.

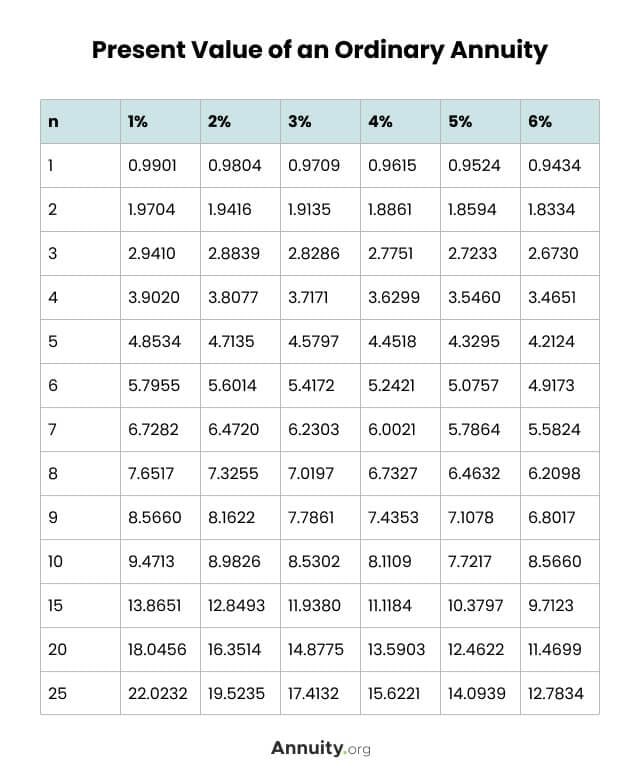

PVIF is the abbreviation of the present value interest factor which is also called present value factor. Use the Present Value of Cash Flows Calculator to calculate the present value of fixed or changing cash flows to allow insight into future profits based on current costs and known interest rates. For example an individual is wanting to calculate the present value of a series of 500 annual payments for 5 years based on a 5 rate.

To give an example there can be two situations first. See How Finance Works for the compound interest formula or the advanced formula with annual additions as well as a calculator for periodic and continuous compounding. This is a guide to Present Value Formula.

Rate Per Period As with any financial formula that involves a rate it is important to make sure that the rate is consistent with the other variables in the formula. PMBOK 6th edition part 1 ch. We also provide a Present Value Calculator with a downloadable excel template.

Thus this present value of an annuity calculator calculates todays value of a future cash flow. If you have 1000 in the bank today then the present value is 1000. 5500 is higher than Rs.

Future Value Factor FVF Calculator Perpetuity Yield PY Present Value of Perpetuity PVP and Perpetuity Payment PP Calculator Present Value PV and Future Value FV Number of Periods Calculator. This PV factor is a number that is always less than one and is calculated by one divided by one plus the rate of interest to the power ie the number of periods over which payments. Where is the number of terms and is the per period interest rate.

In project management the NPV is commonly used and also listed in PMIs Project Management Body of Knowledge source. By looking at a present value annuity factor table the annuity factor for 5 years and 5 rate is 43295. Type in the current AAA corporate bond yieldThe current AAA corporate bond yields in the United States are about 422.

Referring to the previous example if instead the desired value were GCF268442 178296 66888 after having found that GCF268442 178296 is 2 the next step would be to calculate GCF66888 2. The most important factor that has an impact on present value is interest or discount rate. Let us see how to calculate the intrinsic value of a stock using our online intrinsic value calculator.

The present value is simply the value of your money today. This is the present value per dollar received per year for 5 years at 5. How to Calculate Net Present Value.

The Present Value Interest Factor includes time period interest rate and compounding frequency. 5000 then it is better for Company Z to take money after two years otherwise take. Present Value Of An Annuity.

Present value is linear in the amount of payments therefore the. The present value PV is what the cash flow is worth today. Enter the current market price of.

The present value of an annuity is the current value of a set of cash flows in the future given a specified rate of return or discount rate. When you perform a cost-benefit analysis and need to compare different investment alternatives with each other you might consider using the net present value NPV as one of the profitability indicators. Present value of an annuity is finance jargon meaning present value with a cash flow.

Money in - positive values.

Present Value Formula Calculator Examples With Excel Template

Capital Expenditure Report Template 1 Professional Templates Budget Template Free Budget Template Excel Budget Template

Present Value Calculator Basic

Present Value Of An Annuity How To Calculate Examples

Net Present Value Calculator With Example Steps

Future Value Factor Of A Single Sum Or Annuity

Measurement Conversion Chart Measurement Conversion Chart Measurement Conversions Conversion Chart

Time Value Of Money Board Of Equalization

Calculating Present Value Accountingcoach

Annuity Present Value Pv Formula And Calculator Excel Template

Present Value Factor Meaning Calculate Pv Factor

What Is An Annuity Table And How Do You Use One

Profitability Index Formula Calculator Excel Template Regarding Net Present Value Excel Template Excel Templates Agenda Template Meeting Agenda Template

Present Value Calculator

Net Present Value Calculator With Example Steps

Pin On Id Card Template

Future Value Factor Forex Education